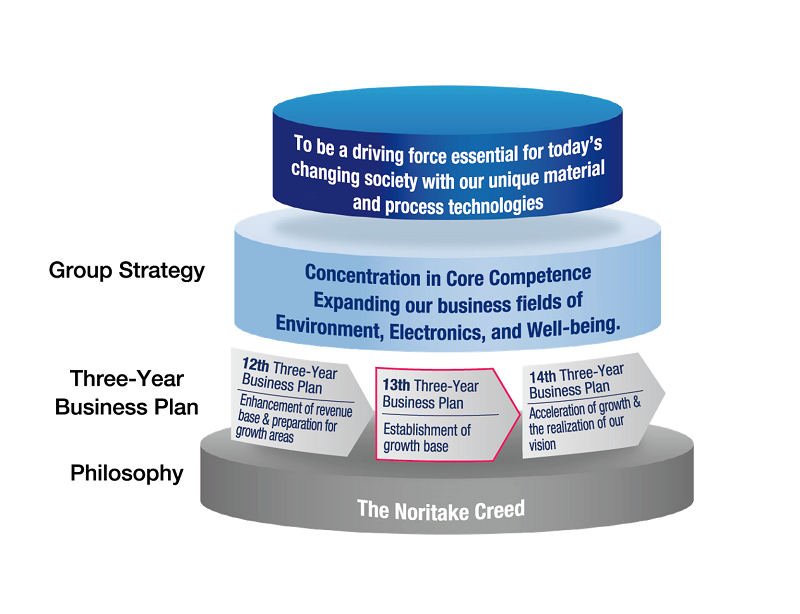

The 13th Three-Year Business Plan

1.VISION2030 (Ideal Target for fiscal 2030)

It is our understanding that the business environment surrounding the Noritake Group (the Company and its group entities) will continue to be uncertain, with an unforeseeable future, due to materialization of geopolitical risk, rise of protectionism, increasing awareness of sustainability including carbon-neutrality, growing interest in mental and physical health and well-being, and the progress in generative AI and digital transformation.

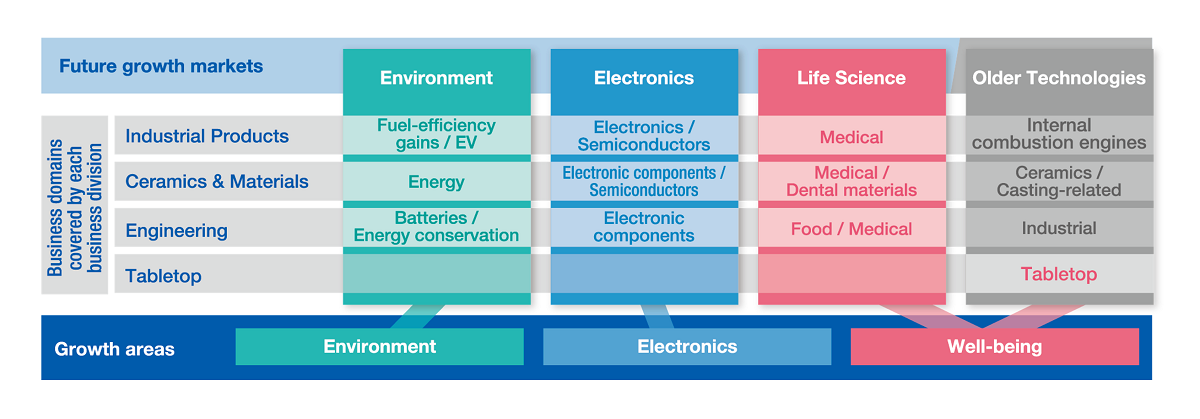

In order to realize the VISION2030 (Ideal Target for fiscal 2030), “To be a driving force essential for today's changing society with our unique materials and process technologies,” which is formulated as a direction looking toward fiscal 2030, we will aim to shift our business domain from the current core areas (industries related to internal combustion engines, ceramics, etc.) to the growth areas (business related to the environment, electronics, and well-being), promoting “Concentration in Core Competence,” as we have identified three business areas that we expect to grow: the environment, electronics, and well-being.

Through our efforts on initiatives for the growth areas, the Noritake Group aims to be a company that realizes and embodies the following commitments, “Contribute to the Global Environment,” “Contribute to a Convenient Society,” and “Contribute to the People’s Well-being.”

2.Review of the 12th Three-Year Business Plan

As we positioned the 12th Three-Year Business Plan for fiscal 2022 through fiscal 2024 as the period for “enhancing the revenue base and preparing for the growth areas,” we promoted reorganization of unprofitable products and businesses, as well as the improvement and rationalization of profitability, as “enhancement of the revenue base.” In addition, we worked on initiatives for increasing production and sales, and enhancement of the management base, as “preparation for the growth areas.”

As a result, while certain results were achieved in terms of “enhancement of the revenue base,” the numerical targets of the 12th Plan were not achieved due to a drastic change of the market environments compared to the time of initial planning.

3.The 13th Three-Year Business Plan

(1) Positioning

The 13th Plan is positioned as a period for establishing a growth base that supports the realization of VISION2030. As a management strategy, the 13th Plan simultaneously promotes the establishment of a solid revenue base and investment in accelerated growth, while working on the advancement of the management base in support of business expansion. It also lays out a process for reorganizing and structurally optimizing our businesses as a means to implement these initiatives.

(2) Numerical targets

Numerical targets for the final year of the 13th Plan (fiscal 2027) include consolidated net sales of ¥157.5 billion, consolidated operating profit of ¥13.5 billion, consolidated ordinary profit of ¥17.5 billion, ROE of 9% or more, and PBR of over 1x, with the aim of achieving this last target at an early stage.

(3) Outline

① Establishment of a solid revenue base

In order to shift our business into growth areas, we are driving increased production and sales through aggressive investment and new product development. In addition, to streamline operations and improve profitability, we are promoting efficiency by renewing aging equipment in conjunction with price adjustments and cost reductions. Furthermore, we are employing external partnerships to expand into upstream and downstream phases of existing businesses and develop new applications for existing products in order to capture high-value-added, highly profitable business opportunities, and thereby, build a solid revenue base.

② Investment in accelerated growth

To ensure further rapid progress during the upcoming 14th Plan (fiscal years 2028 through 2030), which we have positioned as a period for accelerated growth, we are shifting our focus from a conventional product-based approach constrained to each business to a new market-based strategy that explores investment opportunities across growth areas spanning multiple businesses. We are also promoting strategic corporate alliances via M&A, capital alliances, and other methods.

Moreover, we foster new businesses through a companywide effort that leverages a development theme proposal system in which ideas are solicited from all employees and also makes use of a stage-gate process. At the same time, we are moving away from our traditional self-reliant approach in favor of open innovation as a means to spur early-stage business development.

③ Advancement of the management base

To address social issues and contribute to a sustainable society, we will promote sustainability management and advance initiatives for sustainability, such as reaching carbon neutrality and countering such risks as climate change.

We will focus on strengthening human capital management and promoting digital transformation, and will support business growth by enhancing our management foundation on the way to realizing VISION2030.

Strengthening of human capital management

We promote HR measures that complement our business strategy by operating a talent management system that facilitates the visualization of data on employee skills and experience, and by fortifying our investment in people so as to achieve our desired staffing portfolio. We are also moving forward with workstyle reform and improvement of our internal environment, and by establishing a new personnel system based on the roles and achievements of diverse employees, we aim to promote a corporate culture that helps to encourage a spirit of challenge among our staff and to improve engagement.

Promotion of digital transformation

We emphasize digital transformation to enable an agile response to changes in the market and competitive environments. Toward this end, we are building a sophisticated foundation for efficiency by the digitization of internal data, and in conjunction with such initiatives as promoting development with the use of MI*, optimizing workflows, and revitalizing collaboration among manufacture, sales and technology, pursuing fundamental transformation of our internal processes while cultivating core DX talent.

Note: MI (Materials Informatics): a methodology that leverages information science technologies, including AI, to accelerate materials development.

(4) Management conscious of capital costs and stock prices

Under the 13th Plan, we are conscientiously striving toward our goals of 9% ROE by fiscal 2027 and PBR of 1x or more at the earliest opportunity, and at the same time, working to raise our return on capital and market valuation.

Improved return on capital

・By setting business-segment targets for ROIC and managing actual results, we promote capital efficiency

・Actively invest in growth areas (environment, electronics and well-being)

・Continued reduction of cross-shareholdings

Heightened market valuation

・Enhanced shareholder returns

Dividend payout ratio: 30% or more ⇒ 35% or more (During the 13th Plan’s term, the progressive dividend will have a minimum annual amount of ¥140 per share, which is assumed to be double the dividend amount at the end of fiscal 2025.)

Flexible acquisition of treasury stock

Total shareholder return ratio: 50% or more (cumulative total for the 13th Plan term)

・Timely and appropriate disclosure of information on growth strategies and progress

・Strengthening of IR systems and expansion of individual meetings

・Reporting information obtained through dialogue with investors to the meeting of the Board of Directors, and taking measures to resolve issues

(5) Strategies by business segment

Industrial Products Business

In the made-to-order products business, we will continue to work on thorough enhancement of profitability, including expanding sales, optimizing pricing, utilizing OEM partnerships, reducing costs, etc., in addition to reorganization of the business structure shifting to categorization by market, or by growth market, rather than categorization by product, for the purpose of ensuring agile adaptation to market changes.

In standard stock products business, we will work to enhance competitiveness and profitability by reorganizing and improving the manufacturing structures for Japan and Thailand.

We will work to establish and rearrange sales bases domestically and abroad and to reform the sales and manufacturing systems, in addition to working on development of new products targeted at growth areas (mainly, electronics), expansion of sales channels and preparations for the increased production.

Ceramics & Materials Business

In Electronic Paste business, we will work to enter the power semiconductors peripheral materials and to get the mass production of such materials on track, in addition to working to optimize the sales price and to expand the product lineup.

In electronic component raw materials business, we will work to enhance the competitiveness by realization of cost reduction through establishment and rearrangement of production bases, in addition to increasing production capacity of the mainstay materials for multi-layer ceramic capacitors. We have reorganized our business portfolio with printing technology at its core in April 2025. We will newly work to establish a highly profitable and efficient business foundation.

We will proceed with the development of new products for growth areas (environment, electronics, and well-being).

Engineering Business

In the mainstay field of energy and electronics, we will strive to expand our market share by establishment of the development, sales, manufacturing and quality control system, and establishment of the after-sales service system network, including maintenance and sales of consumables, etc.

We will proceed with the entry to the new fields, including pharmaceuticals, semiconductors and circular economy, and the market development as well as the development of new applications and products in the growth areas (environment, electronics, and well-being).

Tabletop Business

In addition to working on improvement of profitability of our business in the USA and establishment of country-specific sales networks, we will also work on new product development, including adoption of the new materials with reduced environmental impact, and will promote the establishment of business foundation on manufacturing, sales and technology.

In addition to the improvement of brand power and the start of entry to the new fields, including interior, lifestyle, etc., we will work on the sales expansion in the overseas HoReCa* market expected to grow in the future.

Note: HoReCa is an abbreviation of Hotel, Restaurant, and Café/Catering.

■Related links

5/9/2025 NEWS RELEASE:Notice Concerning the Formulation of the 13th Three-Year Business Plan