Ceramics & Materials Business

Noritake's Growth Strategy

Main products

● Electronic paste (electronic paste, decalcomania paper, decoration materials)

● Electronic component raw materials ● Ceramic raw materials

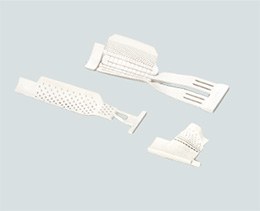

● Ceramics (thick film circuit substrate, plaster, ceramic cores, porous ceramic materials,vacuum fluorescent displays and modules)

-

Decalcomania paper -

Ceramic raw materials for electronic components -

Plaster products -

Electronic paste -

Vacuum fluorescent displays -

Ceramic cores

Performance in Fiscal 2023

Sales of electronic paste and electronic component raw materials increased, supported by steady demand for multi‐layer ceramic capacitor (MLCC) materials for automotive applications, as well as a recovery in demand for use in telecommunications equipment. Despite steady demand for sensor-related application, sales of thick film circuit substrates declined due to the termination of some products. Sales of plaster saw a slight increase. Sales of ceramic cores increased due to recovery in both replacement demand and new demand, while vacuum fluorescent displays performed well in both the Japanese and overseas markets, with favorable exchange rates contributing to sales growth. Sales of ceramic raw materials for heat-resistant glass declined significantly. As a result, net sales for the ceramics & materials business were 46.647 billion yen (a 5.2% decrease from the previous year) while operating profit was 6.179 billion yen (a 27.6% increase from the previous year).

Progress of the 12th Three-year Business Plan

In comparison with the time of drafting the Three-year Business Plan, the negative impact of external factors such as soaring energy, raw material, and logistics costs, as well as the depreciation of the yen, have increased. On the other hand, some businesses have seen improved earnings due to the weaker yen.

In the electronic paste sector, we will continue price revisions in response to the rising cost of materials and improve profitability. Additionally, we will promote “concentration in core competence” of our businesses, expand our product lineup, and develop new products. In the electronic component raw materials sector, we have increased production capacity and established logistics warehouses to meet the growing demand for MLCC. Going forward, we will continue to make capital investments in line with market expansion and develop new products in growth areas.

Meanwhile, in the ceramics business, demand is firm for many products that support industrial infrastructure. Among these, ceramic cores are indispensable for manufacturing turbine blades for aircraft engines and gas turbines for power generation. These are designated as an important item for economic security by the Ministry of Economy, Trade and Industry in 2024, which means we will play an even more important role in the field.

Growth Strategy

Alongside the restructuring of existing businesses and improving profitability, we are advancing investments in growth fields. Currently, we are making large-scale investments at the Miyoshi and Minato Plants, and progressing with the reorganization of plants and the construction of new facilities.

The major objective of these efforts is for the Noritake Group as a whole to grow further in the environment, electronics, and well-being fields. Under the 12th Three-year Business Plan, we are also working to create new businesses by leveraging the elemental technologies we have independently accumulated in each business and product field. Instead of our conventional vertical development, we are taking on the challenge of creating new value from the technologies we have cultivated to date, collaborating with multiple business units as well as with the Research & Development Center and the Production Engineering Center. In addition, we have also started cross-business unit development themes and collaboration with other companies. In fiscal 2024, we expect to further utilize and expand the systems we have established, moving into a phase where various new products will be in production.

Among the three growth areas, our business unit is particularly focused on the electronics sector, which we recognize as a market with significant future growth potential. With the increasing adoption of artificial intelligence (AI), the number of data servers is on the rise, and technologies such as advanced driver assistance systems (ADAS) and electric vehicles (EVs) are also progressing in the automotive market. Against this background, demand for semiconductors and other power devices is steadily increasing.

MLCC, our flagship product, is an essential component for these applications. We aim to capture this growing demand, link this to the growth of our business unit, and ultimately contribute to the further growth of the Noritake Group.

MESSAGE

Work is a team effort: focusing on team building

Group General Manager of Ceramics & Materials Group

Shinji Kato

I took over the role of Group General Manager of Ceramics & Materials Group in April 2024. Needless to say, each of our businesses has grown to where it is today thanks to the cooperation and support of many people.

In a time of great social change and diversification of values, it is more important than ever to cherish the principle of working hard together—or teamwork. At Noritake, we need a workplace environment where every individual feels free to share their candid opinions. By sharing policies and strategies, we can align everyone toward the same goals. We know that a team that achieves this can demonstrate strength beyond imagination. Moreover, it is the leaders, the central figures, who play the role of bringing out the full potential of the team.

There is no one-size-fits-all approach to solving business challenges. This is especially true in times of change like today. Therefore, rather than struggling alone, I would like to ask our members to help one another, regardless of position or rank, and overcome challenges together as one cheerful and united team.