Continuous reinforcement of governance

Sustainability Initiatives

- Sustainability at Noritake

- Contribute to the Global Environment

- Contribute to a Convenient Society

- Contribute to the People’s Well-being

- Strengthen the Foundation

- Management Structure

Basic approach and basic policiestoward corporate governance

At the Noritake Group, every officer and employee inherits the founding spirit of our company, and, by observing and practicing the Noritake Group's Code of Ethics formulated on the basis of that founding spirit, works toward ensuring that Noritake Group keeps to higher corporate ethics. In addition, by providing financial information and non-financial information through our website, we will strive to actively and fairly disclose information and heighten the transparency of our management.

The basic policies concerning our corporate governance are as follows.

Basic policies

- (1) Strive to ensure the rights of shareholders and fairness.

- (2) Strive for appropriate cooperation with stakeholders other than shareholders (customers, suppliers, creditors, local communities, employees, etc.).

- (3) Strive to ensure appropriate information disclosure and transparency.

- (4) Strive to appropriately carry out the roles and responsibilities of the Board of Directors to enhance sustainable growth of the company and medium-to-long term corporate value.

- (5) Strive for constructive dialog with shareholders.

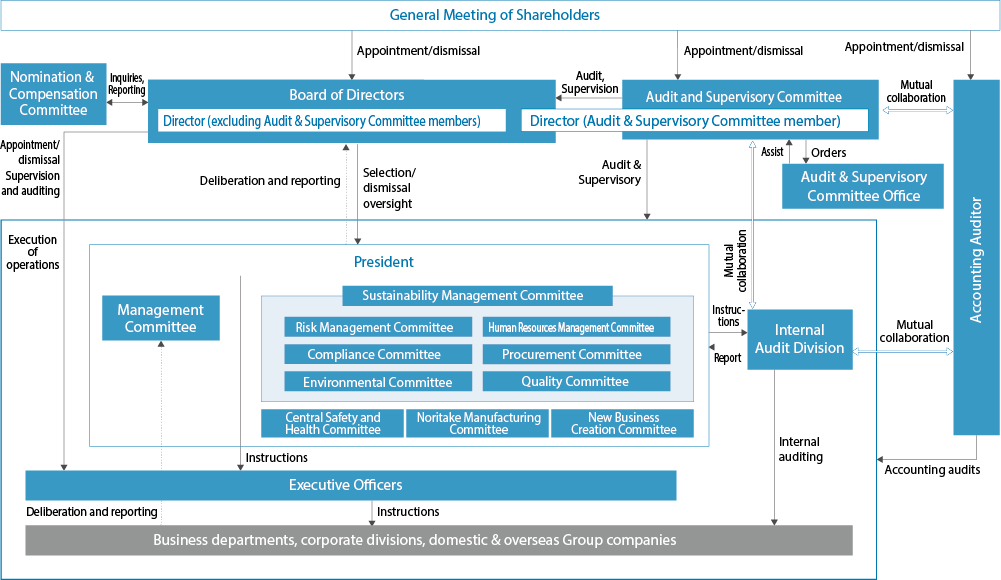

Corporate Governance System

Noritake is further enhancing its corporate governance by strengthening the monitoring function of the Board of Directors, and is choosing a company structure with an Audit and Supervisory Committee, and creating the following system under the company structure with an Audit and Supervisory Committee member with the aim of accelerating decision- ment.

Corporate Governance Structure (as of June 30, 2024)

Board of Directors

Members: 9 Directors

(5 internal Directors (including 1 female), 4 Directors (Outside))

Chairman: Hiroshi Kato, Chairman of the Board of the Board of Directors

The Board of Directors comprises nine Directors (including 4 Directors (Outside)) makes decisions on key matters like management basic policies and matters stipulated by laws and regulations, and monitors the executio n of duties. The Board generally convenes once a month. In accordance with the regulations and deliberation standard of the Board of Directors, deliberations are held to decide items regarding General Meetings of Shareholders, human resources and organizational matters, and financial reporting. The Board of Directors also appoint two Directors (Outside) as part of a system to strengthen oversight functions and ensure transparency in decision-making. The Representative Director is appointed to make decisions for certain matters, who receives reports from the Representative Director and other Executive Directors to supervise the status of execution of operations.

In FY2023, the Board of Directors convened 14 times with a Director attendance rate of 100%.

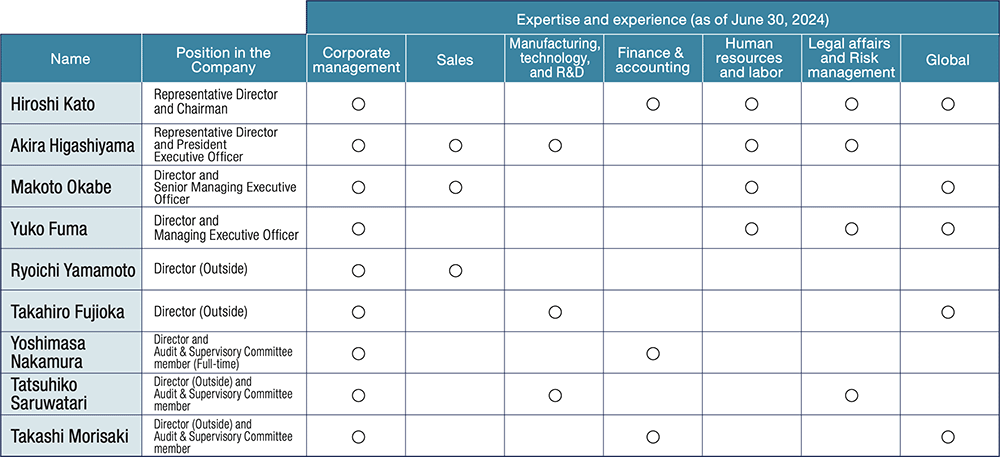

Skills matrix and composition of the Board of Directors

We believe it is important for our Board of Directors to be composed of Directors with diverse perspectives, diverse experiences, and diverse and advanced skills in order to oversee business execution and make important decisions. We ensure the balance and diversity of knowledge, experience, and abilities of the Board of Directors by having, as its members, internal Directors who are familiar with each business and have diverse knowledge and experience, and Directors (Outside) who have abundant experience and deep insight into corporate management.

Key topics of the Board of Directors

During FY2023, deliberations covered the following key issues.

Resolutions

- ● Approval of budget and financial results

- ● Forecast of operating results, amendment of expected dividend amounts

- ● Change in dividend policy

- ● Change of Japanese trade name

- ● Stock split

- ● Sale of investment securities

- ● Construction of a new plant

Reported Matters

- ● Progress of the Three-year Business Plan

- ● Ownership of investment securities

- ● Results of Board of Directors effectiveness evaluation

- ● Management with an awareness of capital costs and stock price

- ● Investment in affiliated companies

- ● Revision of the personnel system

- ● Establishment of the Human Rights Policy

- ● Establishment of the Risk Management Committee

- ● State of activities of the Sustainability Management Committee

- ● State of activities of each committee

Nomination & Compensation Committee

Members: 6 Directors (2 Representative Director, 4 Directors (Outside))

We established the Nomination & Compensation Committee in order to ensure reasonable and transparent decision-making regarding Board of Directors membership and compensation. With independent Directors comprising a majority of its members, the committee serves as an advisory body to the Board of Directors and is generally held twice a year. Based on inquiries from the Board of Directors, the committee discusses personnel matters, assignments and compensation concerning Directors and Executive Officers, then reports to the Board of Directors on the results of its deliberations.

Key Issues for the Nomination & Compensation Committee

During FY2023, deliberations covered the following key issues.

- ● Matters concerning appointment of Executive Officers and work entrusted to Executive Officers

- ● Matters concerning remuneration for Executive Officers such as performance-linked stock compensation

Audit and Supervisory Committee

Members: 3 Directors (1 Standing Audit and Supervisory Committee Member, 2 Audit & Supervisory Board Members (Outside))

The Audit and Supervisory Committee comprises three Audit & Supervisory Board Members (of which 2 are Audit & Supervisory Board Members (Outside)), and audits and monitors the status of execution of duties by Directors. The Audit and Supervisory Committee selects a full-time committee member to ensure effective auditing and monitoring functions by collecting information on a daily basis and by working for somooth coordination between the Accounting Auditors and Internal Audit Department.

Management Committee

Members: 8 Directors

Directors and Executive Officers designated by the President

Regarding key matters for management that involve prosecution of work, we conduct full deliberations in a Management committee, convened once a week regularly and composed of Directors and Executive Officers designated by the Representative Director & President and approved by the Board of Directors, as part of a system for precise and prompt management decision-making.

Evaluations of the effectiveness of Board of Directors

We perform evaluations of the effectiveness of the Board of Directors for the purpose of heightening its effectiveness and increasing corporate value. At the end of each fiscal year, a survey of the Directors is conducted, and the results are analyzed and evaluated by an external organization before being reported to the Board of Directors.

Methodology of the fiscal 2023 effectiveness evaluation and summary of evaluation results

In FY2023, a questionnaire survey was administered to the Board of Directors and Audit & Supervisory Board regarding their evaluation of Board of Directors composition and operation, management and business strategies, corporate ethics and risk management, business performance monitoring, managerial evaluation/compensation, and dialog with shareholders. In addition to the questionnaire, interviews were conducted with non-executive directors. The analysis and evaluation results of the effectiveness of the Board of Directors are as follows.

- ● The Board of Directors is appropriately structured to fulfill its roles and functions.

- ● The selection of agenda items for Board meetings is appropriate. Additionally, briefings are provided before the Board of Directors meetings, ensuring that Directors (Outside) fully understand the relevant information, and active discussions on decision-making take place.

- ● Issues identified in the effectiveness evaluation of the Board of Directors are addressed appropriately.

- ● Active efforts are made to address issues surrounding sustainability, such as the development of a system in response to TCFD recommendations.

- ● The Board of Directors appropriately verifies the propriety of holding cross-shareholdings

- ● The Board of Directors performs appropriate supervision regarding the construction and application of internal control systems.

From the above information, we have confirmed that our company's Board of Directors is operated appropriately, and that its effectiveness is assured.

Response to the issues identified in the fiscal 2022 effectiveness evaluation

Among items listed as issues identified in FY2022 effectiveness evaluation, regarding "revising business portfolios factoring in capital costs", regular reports on the progress of the Three-year Business Plan and the change of business portfolio were submitted to the Board of Directors. Additionally, to achieve the target of 9% ROE set in the 12th Three-year Business Plan, return on invested capital (ROIC) was introduced. Regarding "formulating and implementing an investment and human resource strategy for human capital based on long-term strategies", the current human resources portfolio necessary to realize the business strategy for the 2030 Long-term Vision, was quantitatively assessed and reported to the Board of Directors, and disclosure of human capital was also promoted. Furthermore, a new personnel system was introduced in April 2024 to foster a spirit of challenge and enhance employee engagement. Regarding "strengthening risk management", an ongoing effort since the previous fiscal year, the Sustainability Management Committee analyzed and evaluated risks surrounding the Group, and identified risks of high importance. A risk management system was also established.

Efforts to further improve effectiveness in fiscal 2024

Items derived from the results of the survey and interview indicating areas in which the effectiveness of the Board of Directors may be improved continue to include "revising business portfolios factoring in capital costs" and "formulating and implementing an investment and human capital strategy based on long-term strategies", "strengthening risk management", and the new item of "utilization of dialogue with shareholders for enhancing corporate value". We will address these items as we continue to work to maintain and improve the effectiveness of the Board of Directors.

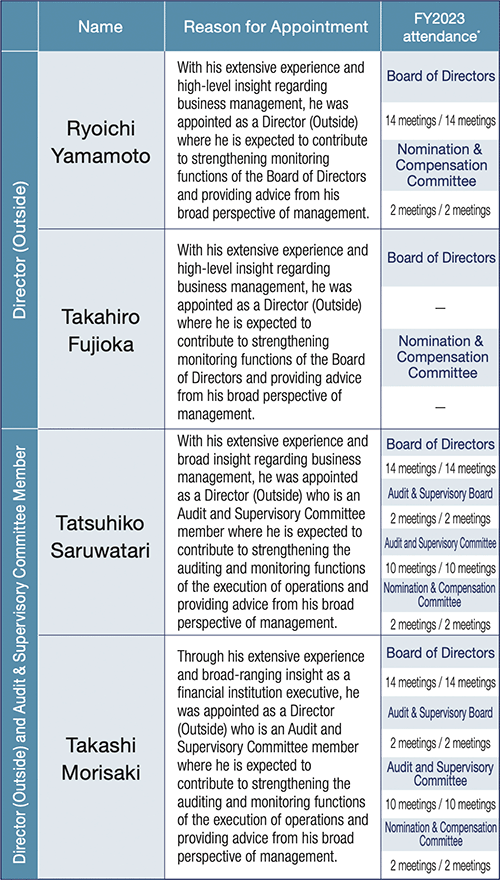

Status of Directors (Outside)

Noritake has four Directors (Outside), of which two are Audit & Supervisory Committee members.

Director (excluding Audit & Supervisory Committee members) Ryoichi Yamamoto and Takahiro Fujioka, and Directors (Outside) who are Audit & Supervisory Committee members Tatsuhiko Saruwatari and Takashi Morisaki have no personal, capital, or business relationships or other conflicts of interest with our company.

While Noritake does not have any particular standards or policies concerning independence for the selection of Directors (Outside) (excluding Directors who are Audit & Supervisory Committee members) and Directors who are Audit & Supervisory Committee members, they are expected to fulfill their functions and roles of providing objective and appropriate audits and supervision based on their expertise and insight, and are appointed based on the underlying policy that there is no possibility of a conflict of interest with general shareholders.

* At the 142nd Annual General Meeting of Shareholders held on June 23, 2023, Noritake transitioned to a Company structure with an Audit and Supervisory Committee following a resolution to amend the Articles of Incorporation. In fiscal 2023, the Audit & Supervisory Board held two meetings prior to the transition, and the Audit and Supervisory Committee held 10 meetings after the transition.

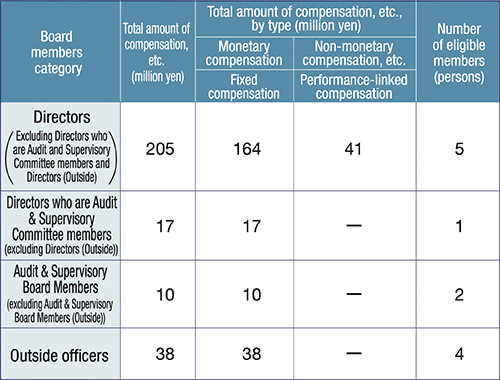

Policies concerning the determination of compensation for Directors, etc.

To decide on individual compensation for Directors (excluding Directors who are Audit and Supervisory Committee members), these matters are deliberated at the Nomination and Compensation Committee comprising a majority of Independent Directors, with the findings reported to the Board of Directors to make a decision.

The decision-making policies for individual compensation of Directors (excluding Directors who are Audit and Supervisory Committee members) are as follows.

a. Policies concerning fixed monthly compensation

Compensation for Directors (excluding Directors who are Audit and Supervisory Committee members) is composed of "fixed monthly compensation," "annual performance-linked stock compensation." and "retirement performance-linked stock compensation." "Fixed monthly compensation" is determined by the Board of Directors within the scope approved by the Shareholders Meeting. Reasonable and transparent decision-making is ensured by a process in which the Nomination and Compensation Committee deliberates and reports its findings to the Board of Directors regarding the appropriateness of compensation amounts for each Directorship position as appropriate to its roles and duties in keeping with the basic policies pertinent to the compensation system.

Compensation for Directors (Outside) (excluding Directors who are Audit and Supervisory Committee members) is only "fixed monthly compensation," taking into account their role in supervising management from an independent standpoint.

Compensation for Directors who are Audit and Supervisory Committee members is only "fixed monthly compensation," which is decided within the scope approved by the Shareholders based on deliberation by Directors who are Audit and Supervisory Committee members.

b. Policies concerning annual performance-linked stock compensation

"Annual performance-linked stock compensation" is provided to Directors (excluding Directors who are Audit and Supervisory Committee members and Directors (Outside)) based on stock compensation regulations to promote early stock ownership and provide incentives for management that takes into account medium-to-long term improvement in corporate value and shareholder value.

For each business year, points are awarded based on the achievement of corporate performance targets (ROIC up to the fiscal year ending March 31, 2025). Directors are granted Company stock in proportion to the points received each year, and receive a cash payment equivalent to the value of their Company stock.

c. Policies concerning retirement performance-linked stock compensation

"Retirement performance-linked stock compensation" is provided to Directors (excluding Directors who are Audit and Supervisory Committee members and Directors (Outside)) based on stock compensation regulations to provide incentives for management that take into account medium-to-long term improvement in corporate value and shareholder value. Points are awarded based on the achievement of corporate performance targets set for each business year in line with the Three-year Business Plan (consolidated sales, consolidated Three-year Business rofit, etc.). The performance-linked compensation indicators for the fiscal year were consolidated sales of 137.9 billion yen and consolidated operating profit of 10.7 billion yen, with the compensation standard corresponding to 100% based on the achievement of these targets. Additionally, Noritake has set the corporate performance targets for the final year of the 12th Three-year Business Plan (fiscal 2022 to 2024) to include consolidated sales of 147 billion yen and a consolidated operating profit of 13 billion yen.

d. Policies concerning the ratio of compensation, etc.

The ratio of "monthly fixed compensation" to "annual performance-linked stock compensation" and "retirement performance-linked stock compensation" is set with an emphasis on stability of medium-to-long term performance and improvement of corporate value and shareholder value, avoiding an excess ratio of "performance-linked stock compensation" linked to business performance.

● Clawback system, etc.

Regarding the annual performance-linked stock compensation, in the event of serious misconduct or violation by Directors or other officers, Noritake reserves the right to revoke the rights of said directors or officers to receive Company stock or equivalent (malus), or to demand the return of the monetary equivalent of stock already granted (clawback).

Total amount of compensation by officer category, total amount by type of compensation, and number of officers eligible (Fiscal 2023)

- 1. On June 23, 2023, Noritake transitioned from a Company with an Audit & Supervisory Board to a Company structure with an Audit and Supervisory Committee.

- 2. Compensation for Directors (excluding Directors who are Audit and Supervisory Committee members and Directors (Outside)) includes compensation for one Director who retired upon the conclusion of the General Meeting of Shareholders held on June 23, 2023.

- 3. Compensation for Audit & Supervisory Board Members (excluding Audit & Supervisory Board members (Outside)) refers to compensation during the term of office for two members who retired upon the conclusion of the General Meeting of Shareholders held on June 23, 2023.

- 4. The amount of performance-linked stock compensation is listed as the provision for share-based remuneration for directors posted as expenses in FY2024.

Training for board members

When we appoint Internal Directors, we conduct appropriate explanations about their legal duties and responsibilities to be observed and make use of external training bodies as necessary. We also offer seminars to the members, to acquire higher skills and new knowledge required for them to perform better. In addition, we regularly conduct in-house training for Officers. In FY2023, we held four sessions on themes including legal affairs in M&A and diversity and inclusion.

For External Directors, we also create individual opportunities to provide them with information about our Group management strategy, the content of our business and work, financial information, and more. In addition, they deepen their understanding of the Group through factory tours and regular interviews with internal officers.

Internal Control

We conduct reviews of our structures to ensure the properness of duties in accordance with revisions to laws and the current state of our Group, and our current Basic Principles on Internal Control Systems were revised through resolution by the Board of Directors on June 23, 2023.

The Internal Audit Division governs internal control regulations for financial reporting, and performs continuous monitoring of work procedures to ensure the reliability of financial reporting. We have also established internal auditing regulations and conduct work audits involving the legal compliance of the business activities of our business divisions and Group companies. Key matters discovered through these initiatives are reported to the Board of Directors or the Management Committee.

Communication with shareholders and investors

We hold the General Meeting of Shareholders at the Noritake headquarters in Nagoya City every year in late June. In June 2024, 40 shareholders attended the 143rd Annual General Meeting of Shareholder and provided open opinions.

In addition, after the announcement of these financial results and the second quarter results, we ordinarily hold a financial results briefing for securities analysts.

Additionally, we are continually improving the website so that shareholders and investors can easily obtain various types of information such as business reports and financial results announcements.

Strengthening of Risk Management

Uncertainty surrounding the impact of global climate change, complex political and economic conditions, and shifting market needs on business continues to increase.

At Noritake, we comprehensively identify and analyze changes in the business environment, conducting risk management from the perspectives of both the risks the company needs to prepare for and the opportunities for further growth in order to control potential risks and create revenue-generating opportunities.

In April 2024, we newly established the Risk Management Committee comprising executive officers, under the Sustainability Management Committee chaired by the President. The Committee meets twice a year to make decisions on risk management measures, monitor progress, and provide instructions to relevant departments and committees.

Disaster readiness and disaster mitigation initiatives

Disaster Prevention Committee meetings are held twice every year companywide, evacuation drills and confirmation of emergency contact networks are regularly conducted in preparation for the occurrence of a large-scale disaster at each business site.

Business groups and business sites have also started developing and formulating business continuity plans (BCPs).

Strengthening of information security

With regard to the protection of personal information and other information assets, we have information security management rules in order to eliminate risks and safely carry out business activities. These rules indicate a code of conduct concerning information security for all officers and employees. We create and employ countermeasure standards and implementation manuals based on this code.

We also have a promotional division under the officer in charge, and are working to strengthen security. To guard against unauthorized access and cyber attacks, we perform strict ID management, logging of PC access, 24-hour monitoring at our Security Operation Center. Drills for targeted e-mail are taken place periodically.

Policies for the protection of personal information

The Noritake Group fully recognizes the importance of the protection of personal information. We comply with Japan's Act on the Protection of Personal Information and heed the laws of other countries as well, and properly manage the personal information provided by customers. The "Rules Regarding the Protection of Personal Information" was revised in January 2023 following revisions enacted for the Personal Information Protection Law, with revisions made to some items and new items added that need to be adhered to.

Ensure commitment to compliance

The Noritake Group has established the Noritake Group's Code of Ethics, setting forth ethical standards for the execution of duties, and ensures that these standards are known by all officers and employees while also focusing on strengthening of compliance and preventive measures.

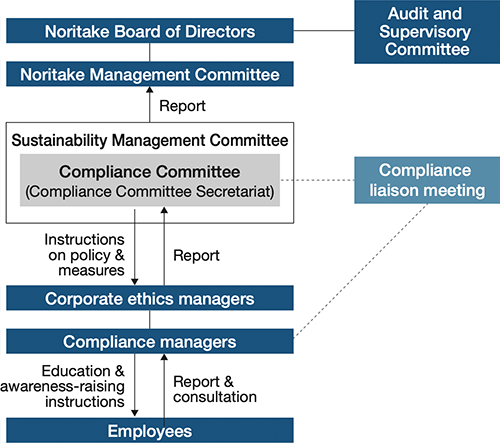

Under the Sustainability Management Committee, we have established a Compliance Committee and its subordinate body Compliance Liaison Meeting. The members of the Compliance Committee are directors in charge of business departments, corporate departments, and main Group companies, as well as legal counsel. All officers serve as corporate ethics managers, and all department heads are in charge of compliance, systematically and continuously promoting compliance activities. The Compliance Committee meets twice a year to decide on compliance measures and check their progress, while the Compliance Liaison Meeting assembles quarterly to share challenges related to compliance promotion, develop measures to prevent compliance violations, and implement various initiatives.

In fiscal 2023, we expanded compliance education through training by qualification, training by organization, training by purpose, and training for staff appointed overseas. We also had a compliance awareness survey. The results are used to formulate and implement strategies to further enhance awareness. Furthermore, we raise awareness of compliance among all officers and employees by providing clear explanations using real-world cases through internal communication channels such as internal newsletters and the intranet.

Promotion structure diagram

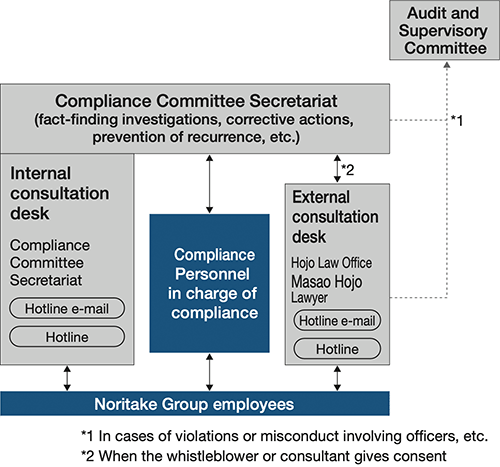

Preparation of an internal reporting system

The Noritake Group has established internal and external points of contact where employees can directly consult or report any compliance violations or suspected misconduct, without having to go through their managers. A total of 19 reports were made during fiscal 2023.

Noritake Group reporting and consultation route

Initiatives to prevent corruption

The Noritake Group's Code of Ethics sets forth ethical standards for the prosecution of work and the observance of laws and ordinances concerning the prevention of bribery and other improprieties, and we ensure that these standards are known among all employees.